Rich without purpose

The Missing Metric of Wealth

This article is inspired by F. Scott Fitzgerald novel : The Great Gatsby

“We make a living by what we get, but we make a life by what we give.” -

Winston Churchill.

When Success Buys Everything But a Reason

We chase the numbers. We climb the ladder. We tell ourselves that once we hit that magic figure, secure that corner office, or achieve that ‘financial freedom,’ then the real living will begin. The modern narrative is a siren song of quantitative achievement: measure your worth in assets, impact in revenue, and happiness in market capitalization.

In this article we explore the depth of this paradox, define a key problem question, and provide a practical framework as a friendly DIY solution based on several researches and readings.

The Glittering Cage of Financial Achievement

The initial premise is deceptively simple: financial success solves problems. It removes the stress of bills, unlocks opportunities, and grants a level of autonomy that those struggling to make ends meet can only dream of. This freedom is real and necessary.

However, the flaw in the logic is assuming that eliminating negative pressures automatically creates a positive fulfillment. Many high earning individuals find that the anxieties of subsistence are simply replaced by the deeper, more existential dread of ‘what now?’ The goalpost, once reached, offers no lasting shelter, only a vantage point from which the remaining emptiness of life becomes acutely visible.

But the truly unsettling revelation is that the pursuit itself often sacrifices the very things that make the resulting success meaningful.

The Opportunity Cost of the Climb

The journey to substantial financial success is rarely paved with leisure and introspection. It demands relentless focus, long hours, and a willingness to postpone personal life, relationships, and holistic well being. This is the hidden transaction: we trade our time the non renewable resource that defines our capacity for purpose-driven action for capital.

By the time the capital is secured, the muscles required for deep, purposive engagement the curiosity, the connection to community, the development of non-commercial skills have often atrophied. You have the means, but you’ve lost the knack for figuring out what the means should serve.

This loss of ‘knack’ leads directly to the observation that true purpose is not a luxury purchased with wealth, but a discipline developed through intentional living.

A Practice, Not a Prize

Unlike a bonus or a stock option, purpose cannot be externalized or delegated. It’s an internal framework a set of deeply held values that dictate how you spend your energy, regardless of your bank balance. A person working on an inspiring community project with minimal pay is practicing purpose. A retired executive funding a project they feel no connection to is not.

Purpose is active; it’s the conscious choice to suffer the difficulties required to bring something meaningful into the world. It’s the intrinsic reward of the doing, not the extrinsic reward of the having.

This intrinsic reward of purposeful action is what financial success, in isolation, fundamentally fails to deliver.

The Hedonic Treadmill and the ‘More’ Mirage

Financial milestones trigger a temporary spike of happiness, but research confirms this quickly fades it’s the classic hedonic adaptation. Our baseline of contentment recalibrates to the new standard.

To feel ‘successful’ again, one must achieve more a bigger house, a higher net worth, a faster car. This creates a relentless, self-defeating loop where the goal is always escaping the current reality, never finding contentment within it. Financial success accelerates the treadmill, but only genuine purpose provides an off-ramp, replacing the fleeting thrill of acquisition with the steady, quiet satisfaction of contribution.

The distinction, then, is that success is about getting, while purpose is about giving—a difference that reshapes the entire experience of being alive.

Redefining Success Through Contribution

The most compelling stories of late-career fulfillment often involve a radical shift in definition: moving from “How much can I accumulate?” to “How much can I allocate?” or “What can I create that will outlast me?”.

True success is the integration of financial stability with a clear, personally meaningful mission. The money becomes the fuel for the purpose, not the destination itself.

It allows you to amplify your chosen contribution to the world, be it art, mentorship, climate solutions, or raising conscious children. The wealth serves the soul, instead of the soul being enslaved to the pursuit of wealth.

Ultimately, the journey from financial success to authentic purpose is a journey of introspection that reclaims the ‘why’ from the noise of the ‘how much’.

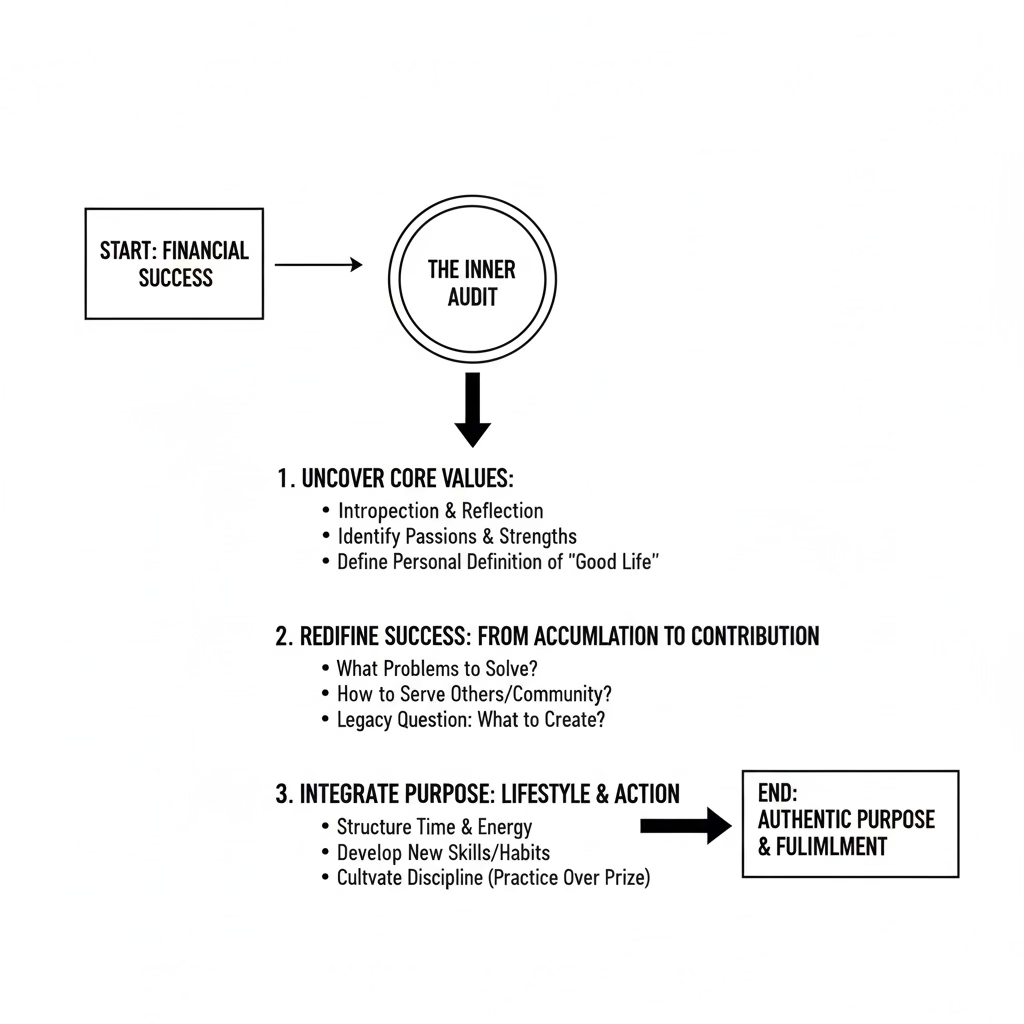

The Necessity of the Inner Audit

The path forward requires an inner audit, a brutal inventory of what truly sparks joy, defines contribution, and aligns with one’s deepest ethical sense. It means deliberately structuring life around the purpose, not fitting purpose into the scraps of time left over from wealth generation.

For many who have ‘won’ the financial game, the next great challenge is to shed the external metrics of success and bravely ask: If my net worth vanished tomorrow, what would I still be proud to be working on?

This question is the crucible of purpose, the true path to a life that is not just rich, but resonant.

Achieving Everything, Yet Feeling Nothing

The core problem our article highlights is the Paradox of Prosperity: achieving significant financial success often leads to a profound lack of purpose or feeling of meaninglessness. This occurs because the relentless pursuit of external metrics (money) overrides the development of internal, intrinsic values (purpose).

In two lines: How do you bridge the gap between financial stability (the “having”) and inner fulfillment (the “being”) after the main external goal has been achieved? Success has provided the freedom to do anything, but has stripped away the clarity on what is worth doing.

Four Steps Reclamation Framework

This framework is designed to help individuals who have achieved financial security transition from Acquisition Mode to Contribution Mode by clarifying their intrinsic purpose.

Step 1. Reclaim Your “Why”

The goal is to move from external validation to intrinsic value.

Action: Conduct a “post-success inventory.” List the core activities, causes, or problems that genuinely held your attention before the pressure of achieving wealth took over, or those that you still find yourself drawn to, regardless of payment.

Key Question: What would you still work on if your net worth vanished tomorrow, and what non commercial skills did you let atrophy during the climb?

Step 2. Define Your Output

The goal is to shift from accumulation to allocation.

Action: Define your unique capacity for contribution by analyzing the intersection of three factors: What you are good at (your skills), What you deeply care about (your values/cause), and What the world needs (your impact).

Key Question: What specific, measurable, non-monetary impact do you want your resources (time, skill, capital) to create in the world?

Step 3. Structure Your Time

The goal is to treat purpose as a discipline, not a holiday.

Action: Dedicate non-negotiable, scheduled blocks of time each week to purpose driven activities. This moves the pursuit of meaning from a vague “someday” ideal to a concrete, prioritized action. Begin by ring-fencing just 5%of your work week.

Key Question: If purpose is a practice, what appointment are you scheduling with it today, and how will you measure your effort, not just the outcome?

Step 4. Validate Your Growth

The goal is to replace the Hedonic Treadmill with sustainable resonance.

Action: Stop measuring success solely by financial returns, and develop Purpose Metrics. These might include depth of connection, hours dedicated to mentorship, improvement in a community you serve, or the creation of a piece of art/work that resonates deeply.

Key Question: How does your work today make you feel more alive, more connected, or more useful than your financial success alone, and what internal metric will you track to prove it?

The glittering cage is unlocked, but only the anchor of purpose will stop the success from floating aimlessly away. It’s time to build a foundation that money can support, but never replace.

Great article, get so wrapped up in the chase for money and it hits home harder with an 8 and 10 year old. Your article made me rethink on aligning my money goals with my true self. Thanks.

Excellantly written! Clear, precise, meaningful. Written well and without being "preachy". I learned some new angles too! Thank you so much for sharing!